Sale-leaseback 101

What it is, why it’s advantageous and when to execute

What is a sale-leaseback?

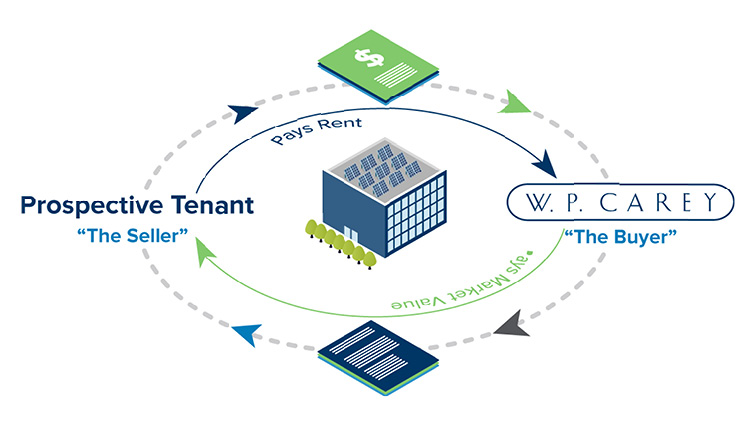

The concept is simple. For many companies, their real estate represents a significant cash value that could be redeployed to fund their core business operations and growth strategies. Through the “sale and leaseback” model (or sale-leaseback), a company sells its real estate to an investor for cash and simultaneously enters into a long-term lease with the new owner. In doing so, the seller extracts 100% of the property’s value and converts an otherwise illiquid asset into working capital, while maintaining full operational control of the facility.

What are the benefits?

There are many reasons why a company would consider monetizing its owned real estate. Sale-leasebacks offer companies an alternative to traditional bank financing. This is particularly advantageous during periods of uncertainty—as seen during COVID-19 when conventional financing was limited, especially for sub-investment grade companies.

Whether a company is looking to invest in R&D, expand into a new market, fund an M&A transaction or simply de-lever, sale-leasebacks serve as a strategic capital allocation tool to fund both internal and external growth in all market conditions.

Key benefits include:

- Immediate access to capital to reinvest in core business operations and growth initiatives with higher equity returns. We like to say that most businesses are not in the business of owning real estate. A sale-leaseback enables companies to focus on its core competencies, while capitalizing on the value arbitrage between the real estate valuation and the company’s EBITDA multiple.

- 100% market value realization of otherwise illiquid assets compared to the 65% to 75% of the appraised value that a typical mortgage would garner.

- Limited financial covenants, unlike some debt instruments, providing the seller with greater control over its operations.

- Alternative capital source when conventional financing is unavailable or limited.

- Retainment of operational control with no disruption to day-to-day operations.

- Potential tax benefits by deducting rental payments rather than being subject to interest limitations for traditional debt as defined by tax laws.

Why now?

Record level dry power, coupled with today’s low interest rate environment continue to drive investor demand for alternative investments such as real estate, pushing property values to all-time highs. These conditions make now an opportune time for sellers to maximize their proceeds and secure favorably priced, long-term capital via a sale-leaseback before interest rates rise again.

In conclusion

Key to the success of a sale-leaseback arrangement is finding an experienced and well-capitalized investor who can understand the unique requirements of each seller and structure the lease accordingly. When working with an investor like W. P. Carey, sellers have the added advantage of gaining a long-term partner who can support its tenants through long-term flexibility and additional capital should they wish to pursue follow-on projects such as expansions or energy retrofits as their business and real estate needs evolve.

Related Topics:

You May Also Like:

MIPIM 2026: Where Capital, Conviction and Opportunity Converge

As the industry gathers once again in Cannes for MIPIM 2026, the European real estate investment landscape appears to be at an important inflection point. After several years defined by volatility, repricing and constrained liquidity, there are growing signs of stabilisation — though the recovery remains uneven and market-specific. Against that backdrop, three questions are likely to dominate conversations at MIPIM this year: Are European transaction volumes expected to improve? How will the sale‑leaseback market evolve amid a significant wall of maturing debt? Which sectors appear best positioned as investors recalibrate their strategies? The Outlook for European Transaction Volumes Pricing expectations between buyers and sellers have adjusted meaningfully over the past 18–24 months, following one of the sharpest repricing cycles the European real estate market has experienced in decades. After a prolonged period of stalled activity, valuations across many markets now show clear signs of stabilisation, supported by greater transparency around interest‑rate policy and financing costs. While long‑term rates remain elevated relative to the pre‑2022 environment, the pace of change has slowed, allowing investors to underwrite returns with greater confidence and begin re‑engaging selectively with the market. This improved clarity around cost of capital is starting to translate into renewed deal momentum in several core European markets. Savills reports that European investment volumes are expected to rise by around 18% in 2026 as pricing firms up, macroeconomic conditions stabilise and institutional capital returns more consistently across the main sectors. That said, recovery is unlikely to be uniform. We continue to see divergence between markets and sectors, with liquidity gravitating toward assets where fundamentals are strongest and underwriting assumptions can be supported over the long term. Sale‑leasebacks and the Growing Need for Capital One of the most prominent themes we expect to discuss at MIPIM 2026 is the growing demand for alternative sources of capital — particularly as a significant amount of corporate and real estate debt comes due this year and next. Across Europe, many owner-occupiers are facing refinancing challenges in an environment where traditional bank lending remains selective and difficult to access. At the same time, businesses are contending with higher operating costs, investment requirements linked to competitiveness, and the need to preserve balance‑sheet flexibility. In this context, sale‑leasebacks are increasingly being viewed as a strategic financing tool. By unlocking capital tied up in real estate, owner-occupiers can redeploy funds toward growth initiatives, operational requirements and debt paydown, while retaining long‑term operational control of their assets. Sectors to Watch: Industrial and Retail When it comes to sector preferences, industrial and retail assets continue to stand out, provided they are underpinned by strong occupier fundamentals. In the industrial space, manufacturing and logistics assets that play a critical role in supply chains remain attractive. Structural trends such as nearshoring, supply‑chain resilience and e‑commerce continue to support demand in many European markets. Assets that are modern, well‑located and tailored to tenant needs are increasingly difficult to replace, reinforcing their long‑term importance. Retail also remains an area of opportunity — particularly for formats that serve non‑discretionary or value‑oriented consumer demand. Grocery‑anchored retail, DIY, and other essential retail categories have demonstrated resilience through economic cycles, supported by consistent foot traffic and defensive spending patterns. A Measured but Constructive Outlook MIPIM 2026 comes at a time when optimism is returning to European real estate markets. While challenges remain, there is growing evidence that capital is being deployed at more significant levels — particularly where opportunities are grounded in fundamentals rather than short-term trends. The conversations in Cannes this year are likely to reflect that balance: pragmatic, selective, but increasingly forward‑looking. For long‑term investors focused on durable cash flows and partnership‑driven transactions, the environment continues to present compelling opportunities.

Forging Long-term Partnerships Through Tenant-centered Real Estate Solutions

At W. P. Carey, we view real estate as a long‑term partnership — not a one‑time transaction. We stay closely connected with our tenants, aligning our capital and real estate expertise with the evolving needs of their businesses. That philosophy is embedded in Carey Tenant Solutions, our platform designed to support tenant growth beyond the initial acquisition. Through follow‑on investments, we help tenants modernize, expand, redevelop, relocate and improve the energy efficiency of their facilities — allowing them to focus capital on what matters most: running and scaling their core business. Below is an overview of the core capabilities within Carey Tenant Solutions and how each can benefit existing and prospective tenants. Build-to-suits In a build‑to‑suit, W. P. Carey funds and manages the construction of a new facility — or the expansion of an existing one — tailored to the precise specifications of a prospective or existing tenant. Upon completion, the tenant enters into a long‑term net lease while retaining full operational control of the new or expanded facility. We offer two flexible approaches to build‑to‑suits: Build-to-suit financing: We provide construction capital while the tenant’s developer executes the project, either through traditional construction financing funded over time or via take‑out financing upon completion. Turnkey build-to-suit: We finance and manage the entire construction process, from site selection to final delivery. For tenants, the primary advantage of a build‑to‑suit is capital efficiency. Rather than tying up their capital in real estate, tenants can redeploy resources toward growth initiatives, innovation or strengthening operations — while still gaining a facility designed specifically for their needs. Learn how this approach helped support our tenant Cuisine Solutions’ growth. Redevelopments W. P. Carey offers comprehensive redevelopment capabilities, managing projects from initial design through delivery. Combining our internal development expertise and long‑standing relationships with leading architects, consultants and contractors, we assemble experienced teams capable of executing even the most complex redevelopment projects. Our redevelopment capabilities span: Repositionings, where we upgrade, modernize or expand an existing building while maintaining its core use. Redevelopments, which involve unlocking value of infill locations through adaptive reuse and ground up construction of state-of-the-art, primarily industrial, properties that meet the demands of modern occupiers. W. P. Carey’s turnkey redevelopment process is comprehensive and includes: Pre-construction planning and optimization Development feasibility and due diligence Zoning and entitlement approvals Design and permitting Budgeting and scheduling Construction management Creative lease structures Sustainable development Overall efficiency Our proactive approach allows us to work directly with incoming tenants to shape a property around their exact operational requirements, while enhancing the quality of our portfolio by retaining the best positioned assets in the highest barrier-to-entry locations. Learn more about our carbon-neutral redevelopment of a Class-A warehouse for a global IT services company. Energy Solutions Through Carey Tenant Solutions, we also help tenants reduce operating costs and advance their sustainability goals by designing, funding and implementing renewable power and energy efficiency projects directly at their facilities. We believe that improving the quality and sustainability of our assets delivers tangible benefits across our portfolio — increasing renewal probabilities, strengthening tenant relationships and enhancing long‑term asset value – all while helping our tenants reduce their carbon footprint. Our energy solutions include: On‑site renewables, including CareySolar® Efficiency retrofits, such as LED lighting upgrades Smart building technologies, including IoT‑enabled metering Green infrastructure, such as EV charging stations and battery storage Carbon‑neutral construction By integrating these solutions into our long‑term ownership strategy, we help tenants operate more efficiently today while building assets that are better positioned for the future. Read how we collaborated with our tenant, a healthcare products distributor, to fund a rooftop solar installation. A Platform Built on Partnership Collaboration with our tenants — and support beyond the initial transaction — has always been core to how we operate at W. P. Carey. With Carey Tenant Solutions, we have formalized and unified those capabilities, bringing decades of experience together under a single platform to deliver one of the most comprehensive tenant service offerings in the net lease industry. Interested in exploring Carey Tenant Solutions? Get in touch today.

2026 Net Lease Outlook

After several years marked by inflation, interest rate uncertainty and selective buyer activity, the U.S. net lease market enters 2026 with more clarity – and more momentum. As pricing resets work through the real estate sector and investors gain confidence in the direction of capital markets, we expect an increase in transaction volume in the year ahead. Below are three predictions set to shape the U.S. net lease landscape in 2026. Transaction Volume Will Rebound as Pricing Stabilizes The reset in valuations throughout 2024 and 2025 has narrowed bid‑ask spreads and revived buyer activity. As the sector digested Fed policy shifts and debt markets steadied, transaction activity began increasing meaningfully – particularly in industrial and logistics. As a result, we expect a measurable uptick in volume in 2026 as investors lean into improved cost‑of‑capital visibility. Colliers forecasts that U.S. CRE transaction volume will grow 15–20% in 2026. Industrial Will Continue to Dominate Industrial demand is positioned to remain strong in 2026. As trade‑policy uncertainty eased in late 2025, many companies who had paused expansion or relocation decisions finally moved forward, bringing a wave of leasing activity that is carrying into the new year. E‑commerce also continues to be a powerful structural driver, underpinning robust leasing demand as retailers and logistics operators expand fulfillment capacity to meet consumer needs. At the same time, development pipelines have slowed, allowing the market to work through new supply. As a result, vacancy is expected to stabilize in 2026, reinforcing a fundamentally balanced environment for investors and occupiers alike. Rising M&A Activity Will Drive New Sale‑Leaseback Opportunities An anticipated rise in M&A activity will likely fuel an increase in sale‑leaseback opportunities in 2026. Private equity firms often use sale-leasebacks to reduce upfront equity requirements and enhance returns when acquiring a new business, especially in deals where real estate represents a meaningful share of the purchase price. On the post-acquisition side, sale-leasebacks can offer PE firms considerable financial flexibility, supporting reinvestment into the portfolio company’s business or even future follow-on acquisitions. Altogether, the anticipated surge in M&A is expected to expand the pipeline of high‑quality real estate coming to market, providing ample opportunity for sale-leaseback investors. Final Thoughts As 2026 unfolds, the U.S. net lease market is entering a period of renewed stability and opportunity. With transaction volumes rebounding, industrial demand holding firm and sale-leaseback activity accelerating alongside M&A trends, investors have multiple avenues to deploy capital strategically. Staying attuned to these drivers will be essential for navigating the year ahead.